The Amazon Effect

There is no denying the power of Amazon. Given their enormous influence in the world of E-commerce (and beyond), they offer the opportunity to dramatically increase both your profits and customer base.

With 100 million dedicated Prime members worldwide and many studies confirming that over half of all product searches begin on Amazon.com, it makes sense why so many small and medium-sized businesses (SMBs) have utilized Amazon to expand their customer base.

In fact, there are many prominent brands who have directly attributed their success to Amazon. In 2017, more than 20,000 SMBs exceeded $1 million in sales through Amazon –and Amazon has moved aggressively into industrial, scientific and healthcare, all massive opportunities that Amazon is transplanting its B2C success on. Amazon Sellers can now simply add Amazon Business Seller capability to their accounts –a classic Amazon frictionless experience luring in new B2B sellers.

While the scale and utility Amazon offers is no doubt appealing, there are a number of factors to consider before diving head first into a selling relationship that has effectively gutted traditional direct to customer distribution channels – rendering them casualties of the Amazon Effect –essentially the confluence of e-commerce, technology, and the changing behavior of buyers –and the sellers that have followed them online

While the rewards can be high, selling on Amazon comes with some risk. While Amazon can help you sell much more than you could elsewhere, you will be compelled to run your business, the Amazon way.

Although Amazon has created an abundance of options and a high level of convenience for consumers, its rising dominion actually poses a number of obstacles and threats for sellers.

Let’s break them down one by one before offering a way to turn the tables and stack the deck in your favor if you do choose (or have already chosen) to sell with Amazon.

1. Amazon isn’t a Buyer’s Market Amazon IS The Market, Buyer & Seller Too.

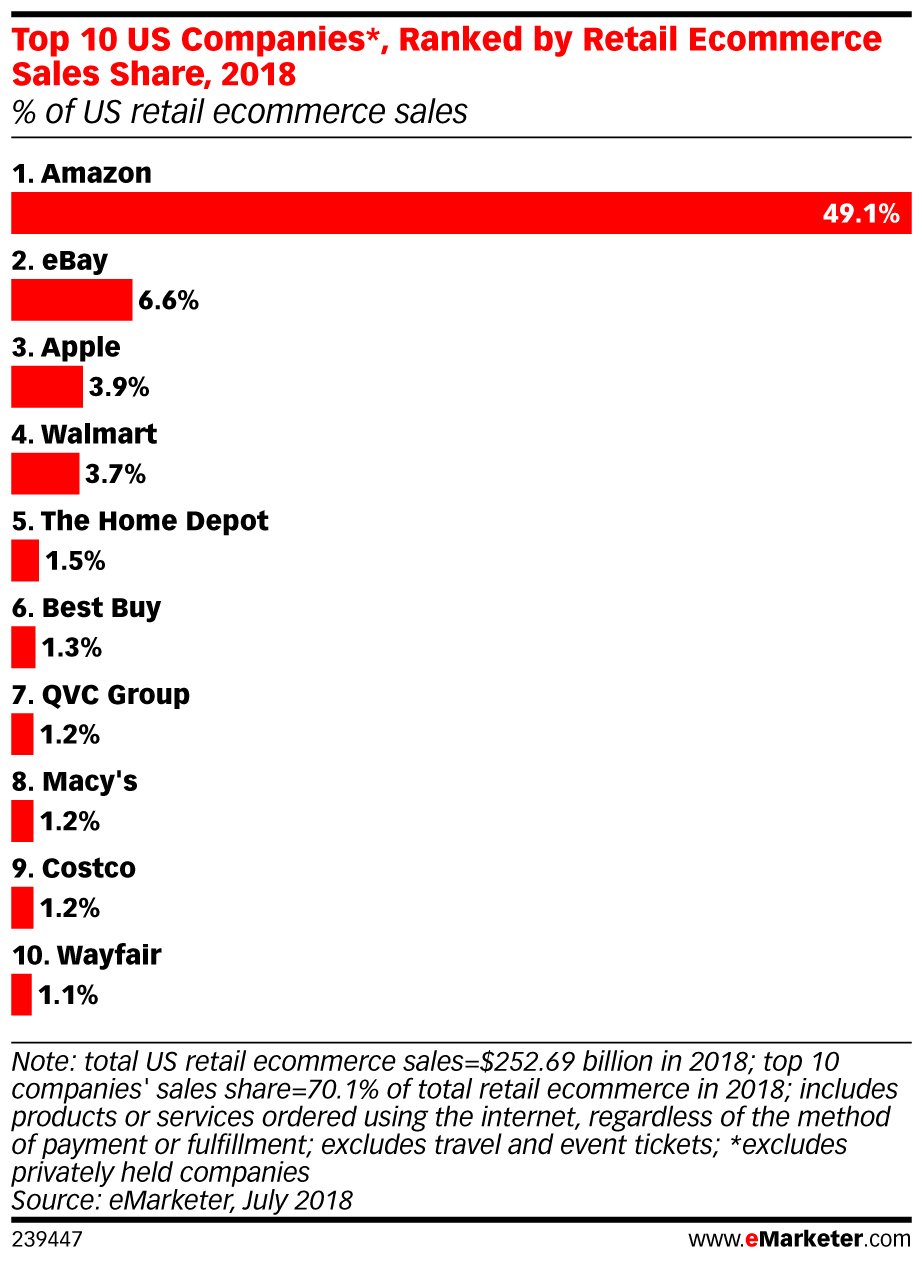

Although Amazon presents itself as having a plethora of potential customers that can seemingly generate a level of demand high enough to outstrip the supply any single retailer could possibly provide – the reality is not that simple.

A condition of the seller relationship with Amazon is affording them considerable power over your pricing, inventory, and brand identity.

Equipped with this power, Amazon systematically pits its sellers against each other. This practice is based upon a science that methodically measures and commoditizes every brand and product with mathematical certainty.

In doing so, Amazon dedicates itself to maintaining a marketplace with the largest selection at the lowest prices. Therefore, even if a customer purchased your product, he/she will be introduced to thousands of other sellers that compete with you both on pricing and product.

Amazon HQ2: An Example of How Amazon Thinks

Actually, During the well-publicized search for its second headquarters, Amazon showcased their culture and economic might when they invited potential host cities in to make bids on how much they would give up to have Amazon. Coupled with some media prowess, Amazon focused on the upside, and lured several major cities into a bidding war. While all large businesses look for the best deal to make large, long term capital investments, Amazon took a very public approach putting pressure on politicians to deliver, and had more cities bidding than is typical in such a process.

After the announcement, cities all across the United States rolled out their respective red carpets – promising massive concessions on taxes and subsidies. This is not unlike the process of getting many dozens of sellers on any given product or category and grinding down sellers on price –to “make it up in volume.”

New York City in particular planned to offer Amazon tax breaks of at least $1.525 billion and cash grants of $325 million, along with other incentives to have one of its HQ2 sites in Long Island City. New York wound up winning their bid, only to have it retracted by Amazon back in February in the wake of opposition from members of the New York State Senate.

Amazon showed New York who\’s boss, and New York Governor Andrew Cuomo is said to have “begged Amazon” to reconsider and calling Jeff Bezos personally.

In addition, an open letter was placed in the New York Times pleading for Bezos to change his mind, stating that Cuomo “would take personal responsibility for the project’s state approval.”

The message Amazon sent was clear: “we own e-commerce, cloud computing, and other major industries) and Amazon makes the rules in Amazon\’s interest first.

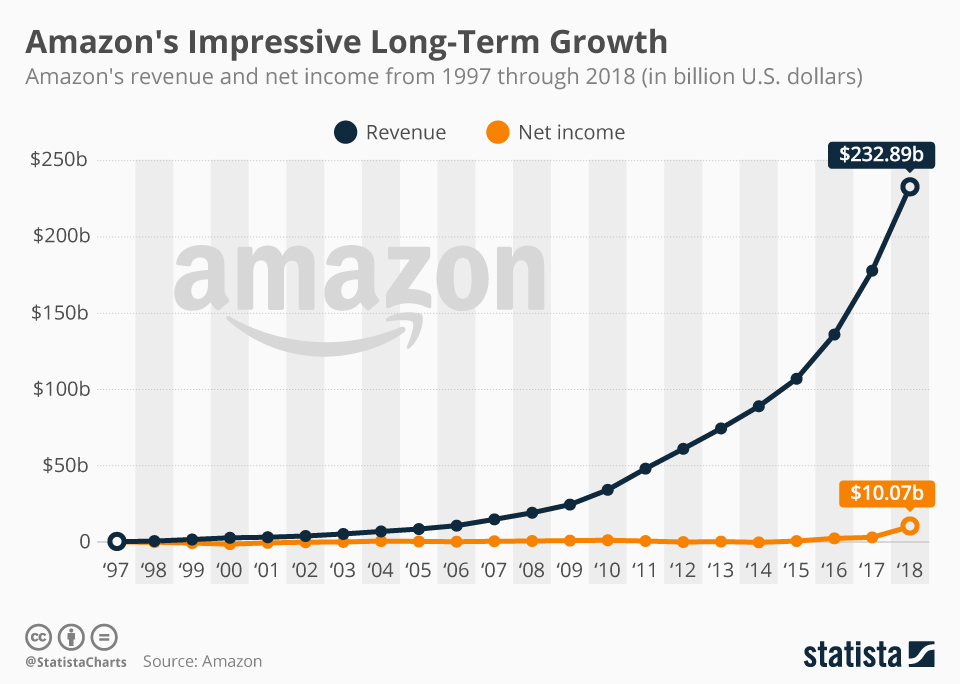

Credit: Statista

2. Data Exhaust

While Sellers and would be Sellers may grow numb to the steady drum beat of the headlines focused on Amazon\’s dominance, there\’s a quiet engine behind the disruption Amazon is causing. Amazon provides an exceptional example of the intelligent use of “data exhaust.\’

Data exhaust is the collection of data produced as a result of doing business. That data, in many cases can be as valuable as the business or transactions that generated it.

As B2C retail raced into Amazon sales “for the (lost) volume,” B2B came next. Amazon Business is already expected to generate $52 billion in sales by 2023. For even the largest manufacturers and distributors –Amazon has buying power that is well on its way to being unmatched. According to RBC Capital Markets analyst Mark Mahaney in a Business Insider presentation.

While Amazon Retail has been an unprecedented success, with a penetration of over 70% in the highest spending households, Amazon Business, a comparatively new venture is doing he same thing in B2B –just faster the second time around…

The B2B Commerce Graph

The Amazon B2B business already has 55 Fortune 100 companies, over 50 of the largest 100 hospitals, and 40 of the local governments serving the 100 biggest populations. Not to mention 80% of the 100 largest educational institutions… and growing.

With all these sellers and buyers, and Amazon\’s data capabilities, Amazon can construct a B2B Commerce Graph, much like Facebook\’s unmatched “Social Graph” that contains the connections behaviors and profile data of the majority of consumers.

The B2B Commerce Graph illustrate where the money is being spent in B2B, on what, when and at what price point. As it grows, the pressure grows for ever more B2B sellers to join that marketplace, have in B2C. With that actionable data set on the majority of B2B sales, we can anticipate the same grinding down of margins in B2B that we\’ve seen in B2C –and the ultimate launch of Amazon brands in each category.

While surely this can bring access, convenience, and lower costs to its 2 million Business Buyers, It also has serious implications for the commodification of B2B brands, as has already started in earnest in B2C.

3. Amazon’s Additional Costs for Sellers

Amazon has created a medium through which an incredible amount of commerce flows. As a result, they are in a huge position of power, and can make even more money by charging tolls for access along the way.

In what has been described as a “pay to play” model, Amazon charges multiple fees for third-party sellers – either on a per-item basis or as a cut of sales. The latter of which can be anywhere from 15-20% of the sale price in addition to listing fees. There are also extra fees for special promotions like Prime Day and Lightning Deals.

Meanwhile, if you decide to register with Fulfillment by Amazon (FBA) – in which Amazon warehouses and fulfills your products – you will usually pay both a listing fee and a fulfillment fee.

Selling through Amazon also often requires paying for both search rank and advertising – since sellers need to develop some sort of presence on the site to gain eyeballs.

Selling ad space on its site has become extremely lucrative for Amazon. In 2018 alone, they reported $10.1 billion for their “Other” category, which they say mainly consists of sales from ad services along with sales tied to their other “service offerings.” In fact, Amazon does not even release its distinct earnings from advertising alone.

Moreover, fighting for ad space can be extremely competitive, and there is no guarantee that consumers will see your ad in lieu of other higher performing products.

As margins get squeezed, only a small group are going to rise to the surface and make it to the top. Usually, only a few select sellers get all of the eyeballs, while everyone else scrambles for whatever they can get.

4. Amazon Owns Your Customers

When you first register to sell with Amazon, you have the option to choose the aforementioned Fulfillment By Amazon (FBA) or Fulfillment by Merchant (FBM). With the latter, you choose to ship your products to each customer through your own logistics and operational processes. Therefore, you have access to the postal addresses of your buyers (more on that later).

Either way, you are never, under any circumstances, allowed to attempt to lead them to your own site.

The reason for this is simple. They are Amazon’s customers – not yours.

At the end of the day, Amazon wants to ensure that customers remain loyal to them – not you.

5. You Can be Suspended or Banned at Any Time

If you do not meet Amazon’s customer service expectations or receive too many negative reviews, you can get suspended – or even possibly banned – without a moment’s notice as these processes become increasingly automated.

Furthermore, sellers who supply inventory to Amazon wholesale can abruptly discover that their product listings have been yanked simply because Amazon’s algorithm (which strongly dictates the relationship between almost all of their sellers) decided that they Can’t Realize a Profit (also known as CRAPping out).

6. Amazon Owns an Expanding Portfolio of Their own Competitive Brands

The truth is, Amazon can be a platform provider, partner, and a powerful competitor all at once.

After perfecting the model for selling other people’s goods, Amazon has doubled down by swaying consumers to purchase their own products.

By 2022, Amazon’s private label sales alone are projected to reach $25 billion. Currently, Amazons owns and operates 139 private label brands and 473 exclusive brands – selling a wide range of items across many categories, including clothing/shoes, electronics, food, furniture, healthcare and beauty, household goods, industrial, and pet/animal products.

While some of Amazon’s private label brands sport its name – like Amazon Essentials or AmazonBasics, there are many more “phantom” brands that don’t. As a result, there are numerous people buying goods directly from Amazon without even knowing it.

Make no mistake. If your brand hasn’t already been challenged by an Amazon brand, the odds are that it will be.

Let’s take a look at another excerpt from the Amazon Services Business Solutions Agreement:

“You grant us a royalty-free, non-exclusive, worldwide, perpetual, irrevocable right and license to use, reproduce, perform, display, distribute, adapt, modify, re-format, create derivative works of, and otherwise commercially or non-commercially exploit in any manner, any and all of Your Materials, and to sublicense the foregoing rights to our Affiliates and operators of Amazon Associated Properties.”

If a certain product or category is performing particularly well, Amazon can just start selling similar ones under a new competitive (yet inconspicuous) brand. And once they see which products are succeeding, they ramp up their production and increase their presence on the site via advertising.

In addition, you don’t just compete with Amazon’s private label brands – you compete with them for share of wallet. Their goal is clear – to obtain as much disposable income from both their customers and sellers as possible.

While Amazon states that third-party brands still make up the bulk of its sales, how much longer could that be the case given their increasingly aggressive private label brand expansions that pull sales away from their sellers?

To make matters worse, in September 2019, Amazon reportedly manipulated its search algorithms to specifically gravitate towards products with higher profit margins. In addition, certain divisions within the company also pushed engineers to showcase their own private label products above others.

Strategic Imperative: Control Your Brand Experience, Customer Relationships, & Data

You may be in a situation where Amazon has moved so quickly in your category, leveraging its unique ability to accelerate growth by making your product a loss leader. If that is the case you likely feel compelled to sell on Amazon, because after all, that\’s where the customers are. You may be a wholesaler or manufacturer accustomed to distribution channels driving a material portion of your sales –after all distributors are valuable revenue driving partners.

Our first caution is, this time its different. It\’s highly unlikely you have ever worked with a distributor as strategic, capable, and competitive as Amazon.

The Customer Relationship

Since we first published on this, Amazon has updated their terms of service. Formerly, the TOS advised that you could not email the customer. The new TOS is expansive in prohibiting brands (sellers) from contacting a customer through any means other than Amazon Customer Service app.

This is an example of Amazon exerting its market might to control and fully own the customer –and at their scale, that represents a challenge, it\’s soon to effectively be “all of them.”

What is not addressed clearly in the Amazon TOS is how they treat a customer who proactively finds you, the Seller/Brand and registers or shops on their website.

Along these lines, brands are encouraging customers to “register” their product on their website, and provide personally identifiable information. While this is no a solicitation to buy, many are concerned about how Amazon might react to this at some point.

Conclusion

The point here is not that Amazon is a “bad” or “evil” company. In fact, what it has managed to accomplish since its inception in 1994 as a small online bookseller is nothing short of astounding.

However, while Amazon may not necessarily be “out to get you,” they are dead set on capturing all of the profits in all of the categories that have them for themselves. You are merely content – or a commodity. Therefore, Amazon ultimately stands to gain more from your relationship than you do.

So before you jump into a selling relationship with Amazon, carefully consider what the conditions (and potential ramifications) are. Know that you and your brand will not only obtain a lower profit margin from each sale, you will also have a giant wall separating you from your actual customers.

If you do elect to sell on Amazon (or already have), consider the direct selling method to take back some control of your customer base. When dealing with such a giant company that carries such a strict set of rules and regulations, take advantage of any outlet you can to bolster your own personal brand awareness and develop personalized customer relationships for yourself.

When you own the customer, you own the future of your business and your brand. Amazon knew this decades ago, and look where they are now.