What is Customer Lifetime Value?

Customer Lifetime Value (CLTV) is a metric marketers use to gauge how much a particular customer is worth to you over their lifetime relationship with your brand.

While this sounds like common sense, too many marketers overlook the importance of proper CLTV calculation. Or, they get it wrong altogether.

Statistics show that it is 5 times more expensive to acquire a customer than to simply retain one. Therefore, shouldn’t you spend your precious marketing resources obtaining the ones with the highest potential value?

If you blindly assume that every customer has the same potential value, then you are likely missing out on a range of opportunities.

Let’s break down the key ways to calculate customer lifetime value in order to stack the deck in your favor and gain a distinct advantage over your competition.

Understand the Acquisition Source

You can learn a great deal of valuable information about a customer’s value by knowing which source led them to your brand.

For instance, a customer found through a discounted offer on Facebook might have an average potential value, while the value of a customer who discovered you through organic search is likely higher since they were actively looking for you in the first place.

Frequently, the future lifetime value (FLTV) of customers is tied to both channel or media source that they were funneled through (i.e. email, paid/organic search, social media) and the type of message or call to action (CTA) that brought them into the fold.

For example, a customer acquired through a sale offer on social media would generally have a lower FLTV than another who came through organic search. This is because the latter was likely actively seeking you out in the first place.

Paid Search and Social Media Analysis

When utilizing paid search via a search engine like Google for customer acquisition, you are given a complete overview of search terms tied to both your products and the types of customers that each one funnelled into your brand.

Equipped with this information, you can grant priority to the specific search that drew in the higher value customers.

Determine Acquisition Allowables

An acquisition allowable (or Allowable Acquisition Cost) is the amount you are able to spend to acquire a new customer in order to meet your Return on Advertising Spend (ROAS) goal. While every business has a different method for determining allowables, they are usually identified by both channel, offer, and projected CLTV.

Let’s say you calculate that a customer is going to be worth $100, and your return on marketing spend has to be at least 100 percent. In that case, you can spend up to $50 on each customer that you acquire. So if you spend $50 on an acquisition and need a 100% ROI, then each customer must generate $100 worth of revenue.

Below is the formula for calculating acquisition allowable.=:

Acquisition Allowable = LTV/ AS x 100 > ROAS Goal

- LTV = Customer Lifetime Value, net of acquisition spend

- AS = Acquisition Spend

- ROAS Goal = Return on Acquisition Spend Goal Percentage

With acquisition campaigns, some efforts are going to be grand slams, while others can be strikeouts. Predictive Marketing Automation (PMA) platforms allow you to keep close track of promotion history, revealing how effectively you are spending your money while acquiring new customers by channel and offer.

From there, you are in a position to improve the LTV of customers over time, adjust your allowable advertising costs, and optimize your marketing and media budgets.

Predict [And Increase] Future Lifetime Value

A core element of customer acquisition is to not just seek to acquire any customer at all, but rather the ones with the highest projected future lifetime value (FLTV).

In turn, you can utilize a PMA to locate behavioral patterns or signals that indicate the relative likelihood of someone becoming a future Most Valuable Buyer (MVB). These are called predictors of Future Lifetime Value.

The more one-time buyers (who have zero recurring value) you have in your customer base, the less profitable your company will be.

On the other hand, your highest value customers (also known as most valuable buyers – or MVBs) are the loyal ones who both purchase more, more often than the rest of your customer base. Not only do they drive the majority of your revenue – they are the lifeblood of your business itself.

Don’t be afraid to spend to get high-value customers. You might be breaking even or losing on the first transaction, but the first transaction does not equal the full value of the customer over the lifetime of your brand.

Always strive to increase the LTV of your customers. If their projected value is increasing as a whole, you are on the right track. If it’s decreasing, reassess your strategy and make use of the tools at your disposal.

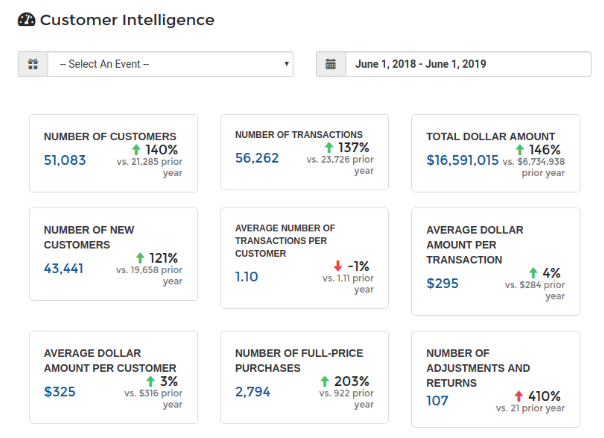

For instance, a PMA dashboard (pictured below) lists the numbers in real time for analysis. From there, you can discern the causes behind your problems and adjust accordingly.

Key Takeaways

Ultimately, you should be able to answer the following key set of questions:

- What is the overall value of the customers we have? Is it trending upwards or downwards?

- Are we maximizing the full potential of each customer that we have in our database?

- How much should we invest in each customer down the road? Via which channel(s)?

- Who (and where) are our customers with the highest potential value? How can we acquire (or retain them)?

Equipped with this knowledge, you can tailor your interactions and offers accordingly in order to acquire (and retain) customers with both the highest LTV and longest lifespans. This pays huge dividends and by increasing both your profits and ROI.

*This blog contains references to a previous post: How to Get More Customers Through Targeted Acquisition*