Segmentation Strategies

In

Part 2 of our Marketing Nirvana series, you learned how to identify who your customers are (sometimes referred to as a buyer’s persona), where they come from, how they purchase your products, and their preferences.

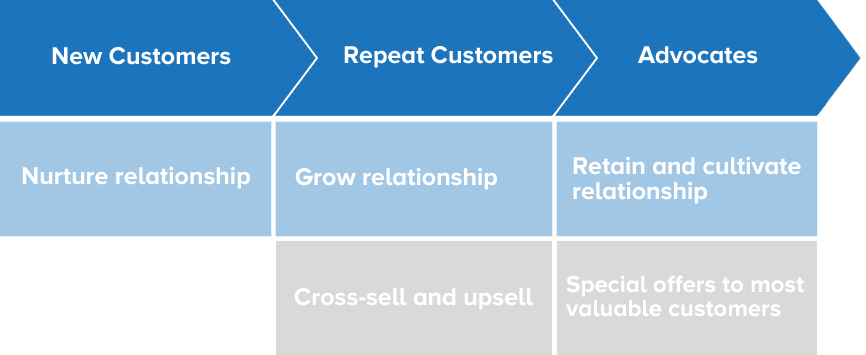

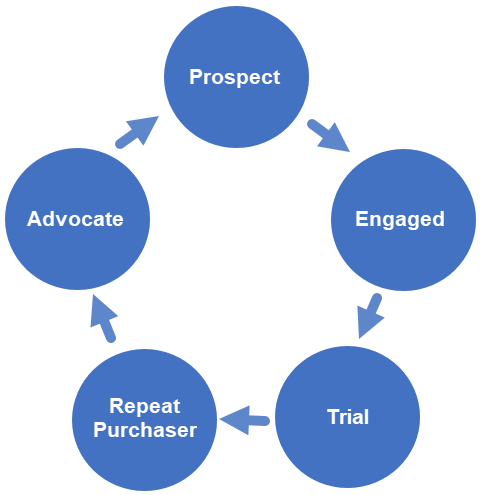

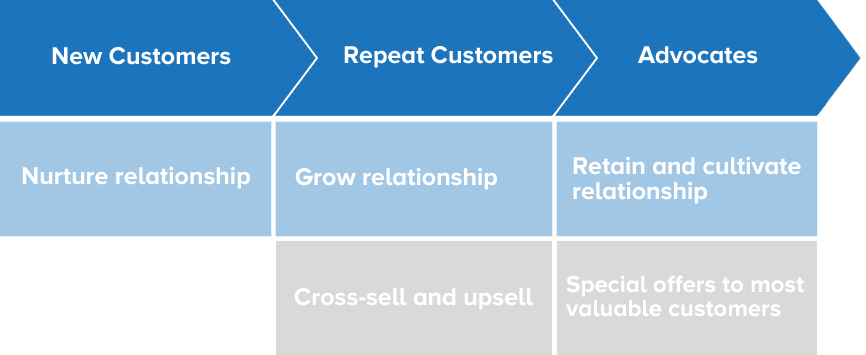

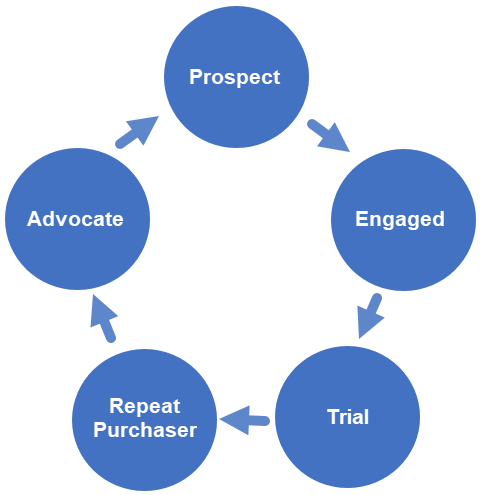

We also broke down the Buyer Lifecycle (BLC) and how it relates to the natural progression of a customer/retailer relationship.

Now you have the ability to apply all of that information towards building intelligent, targeted, personalized, cost-effective marketing plans and strategies.

Keep in mind, a chief goal of curating Customer Journeys and Customer Relationship Management is to maximize the lifetime value of customers by curating an experience that

turns customers into advocates.

In order to do that, you must design distinct segmentation, modeling, and messaging strategies based on customer wants, needs, and

value.

This is where you take the segments you developed

back in Step 2 and put them into action.

Value-based Segmentation

Another component of segmentation that we have not yet discussed is

value-based segmentation. This practice helps you to identify and target a certain group of customers who spend more money, more often than the rest – hence rendering them more valuable.

Equipped with comprehensive customer transaction histories, a PMA can calculate each of their respective potential value – offering perceptive calculations about the future marketing investment that is appropriate for each customer.

For instance, a casino may offer a free night’s stay (with meals included) to a rated player who has a high potential value. Meanwhile, a guest without a known gaming history might receive a lesser incentive to stay.

In this case, the return on investment (ROI) becomes the guiding metric. However, this is just one example of value segmentation. Retailers, airlines, and restaurants also target marketing offers based on customer value.

It is of great importance while developing customer journeys to create a dialogue that is both

relevant to each individual customer and has a high return on promotional investment (ROPI).

This is a paramount priority when it comes to new customers who are interacting with your brand for the first time.

New Customers – One-time Buyers [High and Low Value]

To reach Marketing Nirvana, your aim should not be to just get any customer – but the right type of new customer.

For many retailers, a whopping

75 percent of buyers do not come back after their first purchase. These are called

one-time buyers.

One-time buyers offer no recurring revenue and are much less profitable than customers who purchase frequently. As such, you should provide new customers with a special dialogue designed to cultivate a new relationship and encourage repeat purchases.

It is also critical to factor in the difference between high and low value new customers. Unnecessary focus on the latter is not a recipe for sustained success – especially since it costs so much to attract new buyers in the first place.

Reaffirmation

Encountering a new customer is similar to going on a first date – where you have the opportunity to demonstrate both your brand’s value and the value of your product portfolio.

Most new buyers require some form of reaffirmation. To do that, answer these questions for them:

- What makes your product(s) so special?

- Why should they only shop with you as opposed to your competitors?

- What type of personalized customer experience can you offer?

This opening dialogue – in which you educate customers about

who you really are – is extremely important. You have to go in with the assumption that any new customer can ultimately become a Most Valuable Buyer (more on that to come).

In this instance, put your best foot forward by guiding the conversation towards the areas of interest where he/she is most likely to be receptive. This can be achieved by shifting the conversation towards certain products based upon

past purchases.

Future Lifetime Value

With a PMA, you can identify behavior patterns or signals that indicate the relative likelihood of someone becoming a future Most Valuable Buyer (MVB). These are called

predictors of Future Lifetime Value.

Examples include the frequency of purchase, amount they spend, level of engagement, segments/cohorts they belong to, and their respective lifestages.

As you begin to formulate this targeted, personalized relationship with your customers, they become more likely to be receptive to your messages, offers, and promotions.

Cross-sell and Upsell Journeys

Another way to generate more

high value customers is through the implementation of cross-sell and upsell journeys.

Cross and upsell campaigns work best under a certain set of conditions:

- When coordinated across channels,

- When they include dynamic product recommendations,

- When they are delivered with relative timeliness compared to a customer’s latest purchase.

- When the offering is highly relevant to the customer

PMAs allow us to analyze sequences of product purchases and target the likely subsequent purchases of customers.

For example, if you sell golf equipment, and a customer just bought a set of golf clubs, then there is a good chance that they will buy a pair of golf shoes, balls, and gloves in the near future.

From there, see what else he/she has bought recently, and offer relevant product suggestions that they are most likely to buy. This is the practice of

cross-selling – or tying similar product suggestions together in order to maximize profitability.

Other cases might call for upselling. Upselling is a method used to motivate customers to purchase a similar high-end product over the one in question.

For instance if a customer is only purchasing low-end golf balls or tees, then you should seek to

up-sell – or drive them towards more high-end, expensive versions of the same items.

Another example would be if you are a sneaker retailer, and a customer is only buying low-end, discount sneakers. If you know he/she is classified as a bargain seeker, you could offer a 10 percent discount on a considerably more expensive pair.

Best Customers – Most Valuable Buyers (MVBs)

The fact is, not all customers are created equally – nor should they be treated as such.

|

Cara |

Sarah |

|

High-Value Buyer |

One-Time Buyer |

| Potential Value |

High |

Low |

| Segment/Cluster |

Up & Coming |

Busy & Overworked |

| Location |

City |

Suburb |

| Income |

$100,000 |

$60,000 |

| Channel |

Online & Offline |

Online Only |

| Last Purchase Date |

Less Than 6 Months Ago |

More Than 12 Months Ago |

| Life-To-Date Transactions |

4 |

1 |

| Product Categories Purchased |

2 |

1 |

MVBs are the loyal, repeat consumers who are willing to spend more money, more often than the rest of your base.

According to the

Pareto Principle (also known as the 80/20 rule), for most companies, roughly

80 percent of total profit comes from just

20 percent of the customers.

For retailers, the pareto principle holds true.

This is a major statistic that many marketers are not aware of. Therefore, companies should invest more into

keeping their best customers and

finding more like them.

Once you have identified a customer as an MVB, your objective is to keep them there. There are a number of tried-and-true ways to make this happen.

Surprise and Delight

The tactic of “Surprise and Delight” is a great way to reaffirm connections and reinforce your customers’ attachment to your brand through certain gestures – namely, by making them feel special.

One way this is done is by employing the software’s ESP (Email Service Provider) functions to send a special offer, privilege, gift, or discount for your product or service at a carefully coordinated point in time.

This is a simple practice that can be tailored for different purposes for all types of customers.

In the case of an MVB, you can send them a special gift or offer thanking them for their loyalty. This serves to validate their current spending habits, and perhaps encourages them to engage with your brand even further.

Churn [Customer Attrition]

As stated earlier, one of the ultimate methods of reaching Marketing Nirvana is to

create advocates and reduce churn.

Churn is a metric that that measures the percentage of customers who terminate their relationship within a particular time period.

Most companies have their own respective definitions of what a reporting time period is (whether it’s a quarter or a year) before a customer is considered inactive. The most common is over a one-year period.

If you’re looking at the overall relationship and retention rate of customers, you should be keeping a close eye on churn rates over time – because if it’s decreasing, you’re doing something right. However, if churn rate is increasing, something needs to change.

Going back to the Buyer Lifecycle (BLC), It is important to look at the percentage of customers that are fading and those that have become active over time. This helps you know if you are serving our customers well, or if you are perhaps beginning to lose them and have to change your approach.

For fading/inactive customers, a certain kind of special offer, message, or promotion can be sent in order to lure them back towards spending with your brand again.

Lapsed (Fading) Customers

Market research studies indicate that acquiring a new customer is anywhere from

five to 25 times more expensive than retaining an existing customer. Moreover, it is at least

5 times easier to keep a current customer than it is to acquire a new one.

This means that the act of “rescuing” fading customers through marketing intervention is extremely critical – particularly because increasing customer retention rates by just

5 percent increases profits from 25 to 95 percent.

The truth is, most customers have a start and end date to their relationship with any brand. As a marketer, seek to identify if a customer is starting to lapse by checking if they are no longer purchasing at the rate they did before.

If that is the case, it becomes your objective to get them back on track.

Two Types of Faders

There are really two different types of faders –

profitable and

unprofitable – which means that the amount of potential profits you can regain by “rescuing” or “reactivating” each customer is based on the segment they’re coming from.

Certainly, you should not waste your precious marketing resources attempting to retain fading/inactive customers that have not demonstrated any positive engagement or indicators of long term value in the past.

This goes back to the importance of identifying high and low-value customers based on their expected future value.

Meanwhile, if a profitable customer (high-value, MVB) begins to fade – or even worse – suddenly becomes inactive, the corrective action should be taken right away.

Again, this can only be accomplished if you have a tool that tracks shifts like these along the BLC.

A PMA can autonomously identify these movements and strategically reach out to faders/at risks before they become inactives, or implement a

call to action for inactives to return.

The notion that we are driving towards here is that you can put

stop gaps in place that help identify the

early warning signs associated with churn – and take corrective action.

This is a remarkably beneficial byproduct of loading your data into this platform that closely monitors the buyer lifecycle.

Conclusion

This third section helps you understand how to best utilize targeted, omnichannel analysis/communication to identify which customers are the most profitable – or who you should invest the bulk of your time/money/resources catering to.

Once again, not all customers are – and should be – treated equally.

Everyone is on a different customer journey and trajectory. Their customer personas, BLC stages, and respective financial values to your brand are all different.

If you are a smart marketer, you can gain valuable insights from the types of purchases that were made, the amount spent, when they occurred, and the marketing actions that were successful in driving sales. From there, leverage that information to lead each customer along a journey that reaches their

maximum potential value.

This makes a PMA platform is particularly valuable because it allows you to keep track of tenure, LTV, and your customers’ potential market basket. In turn, you can customize messages over time to keep your valuable customers engaged (and spending) while monitoring that “evil” factor called churn that drains profitability.

Such an approach leads to the notion of true,

automated 1:1 personalization.

By utilizing a capability known as

dynamic variable content, a marketer may personalize each communication with well-proven, relevant product offerings. This practice offers the ability to

autonomously communicate with all of your customers in a familiar, intimate,

personalized way similar to that of a small neighborhood shop owner.

This is truly the culmination of a longstanding marketing vision (stretching back multiple decades) that we are now finally reaching through this cutting-edge software platform.

Looking ahead to

Step 4, entitled:

Launch Customer Journey-based Email Campaigns, you will learn how to further apply all of these insights and strategies towards designing targeted, intelligent, successful email campaigns.

About the Author:

Gary’s background includes over 30 years of analytics & database innovation for several leading Fortune 500 companies and Madison Avenue advertising agencies. Gary has been a frequent lecturer and author on the topics of database marketing and applied statistics. His articles have been published in DM News, Direct Marketing and the Journal of Direct Marketing. He recently was President of the Direct Marketing Idea Exchange and served on their Board. Gary received his M.S. in Industrial Administration from Carnegie Mellon University.

Any further questions or insight? Email Gary at gbeck@buyergenomics.com.

In order to do that, you must design distinct segmentation, modeling, and messaging strategies based on customer wants, needs, and value.

This is where you take the segments you developed back in Step 2 and put them into action.

In order to do that, you must design distinct segmentation, modeling, and messaging strategies based on customer wants, needs, and value.

This is where you take the segments you developed back in Step 2 and put them into action.